Get a financial aid estimate!

2024-25 Financial Aid Estimates are available at Olivet through the 2024-25 FAFSA Estimator. Just click the blue “Start Estimate” button (it takes about 10 minutes to complete and uses 2022 income. Then, send it to your New Student Financial Aid Advisor and we will send you an estimate for Olivet within 24 hours.

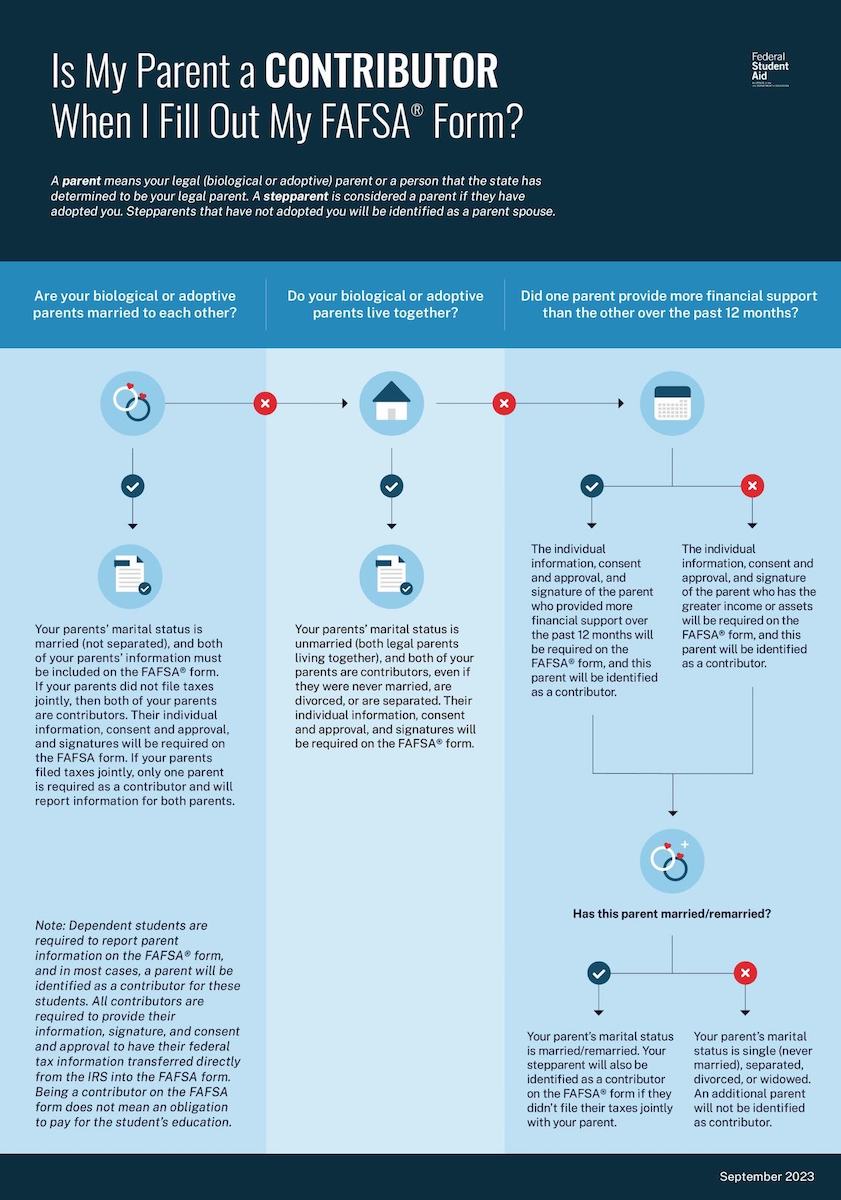

The new 2024-2025 FAFSA is now faster and easier than ever to fill out! Complete it here today! First, a few updates, and then, we will provide you with some tips for completing the new FAFSA.

Updates

- On January 30, 2024, the US Department of Education (DOE) announced that they will begin sending 2024-25 FAFSA results to colleges and universities in Early March. That means, if you have already completed and submitted your 2024-25 FAFSA – we will not receive it until mid-March, 2024.

- On January 30, 2024, the DOE also informed us that 2024-25 FAFSA Applicants who have submitted their FAFSA will receive an email in early March, 2024 – informing them that their FAFSA has been processed. That means, you can begin making changes to your 2024-25 FAFSA once you receive the federal student aid email. Prior to that email, no updates can be made to your 2024-25 FAFSA.

- When will I know my costs for Olivet? We will begin awarding and mailing 2024-25 Financial Aid Offer letters beginning by April 1, 2024 and every day after that until every student is awarded.

We will continue to post updates to this page as we receive additional information from the U.S. Department of Education.